GENERAL INFORMATION ABOUT THE SPECIAL MEETING

TABLE OF CONTENTS

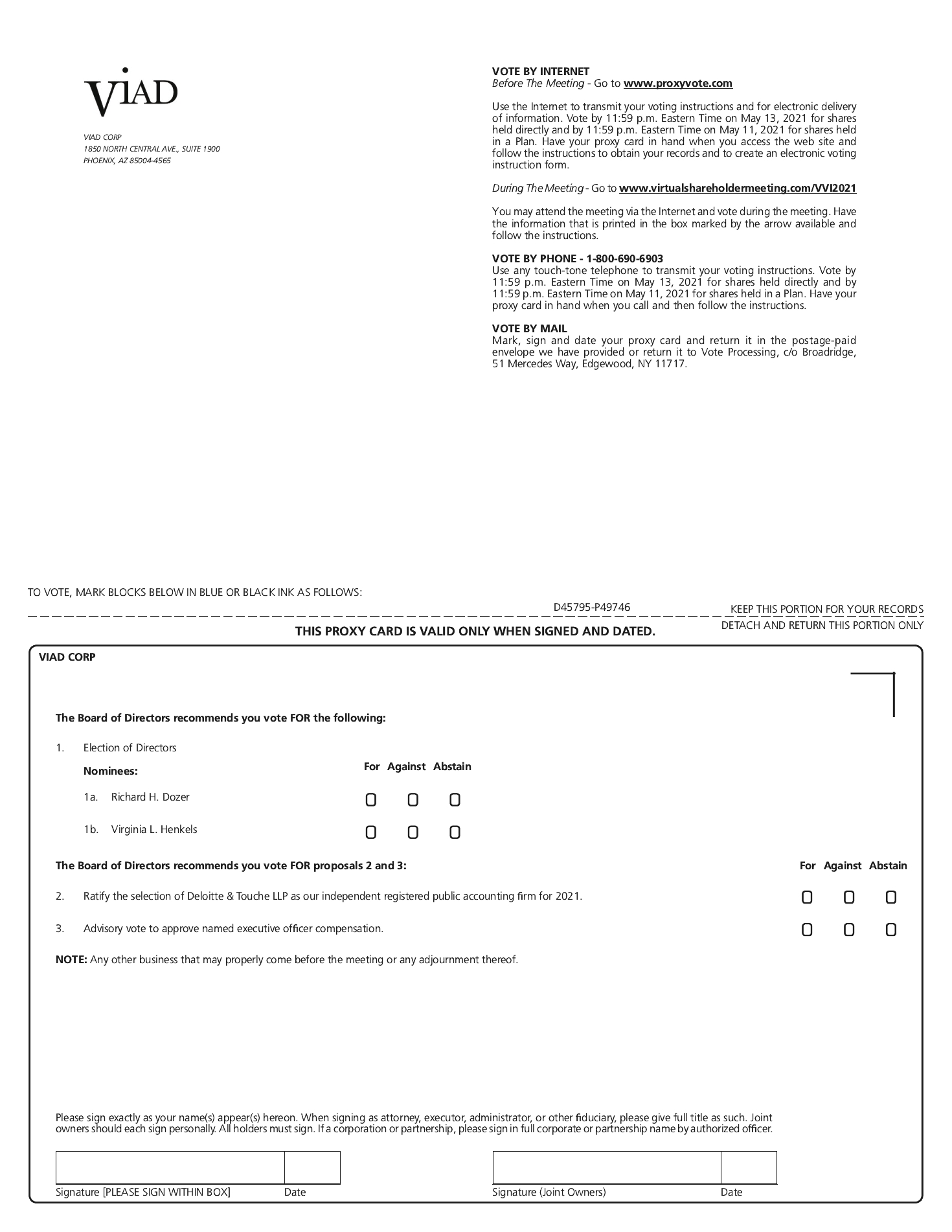

WHY AM I RECEIVING THIS PROXY STATEMENT?ThePROPOSAL 1: ELECTION OF DIRECTORS

Our Corporate Governance and Nominating Committee recommended, and our Board of Directors

(the “Board”)nominated, the two incumbent directors listed below under “Director Nominees.” Each of the

Companydirector nominees is

inviting you to vote at Viad’s Special Meeting of Stockholders (including any adjournments or postponements, the “Special Meeting”) because you were a stockholder of record at the close of business on the Record Date and may be entitled to vote at the Special Meeting. This proxy statement summarizes information that is intended to assist you in making an informed vote on the proposals described in the proxy statement.WHAT IS THE PURPOSE OF THE SPECIAL MEETING?

On August 5, 2020, we entered into an Investment Agreement (the “Investment Agreement”) with Crestview IV VC TE Holdings, LLC, a Delaware limited liability company (“Crestview VC TE”), Crestview IV VC Holdings, L.P., a Delaware limited partnership (“Crestview VC Holdings”), and Crestview IV VC CI Holdings, L.P., a Delaware limited partnership (“Crestview VC CI” and, together with Crestview VC TE and Crestview VC Holdings, the “Crestview Parties” and each, a “Crestview Party”). Pursuant to the Investment Agreement, the Company agreed to issue and sell to the Crestview Parties, in a private placement (the “Private Placement”) up to 180,000 shares of a newly created series of the Company’s preferred stock, par value $0.01 per share, designated as “5.5% Series A Convertible Preferred Stock” (the “Preferred Stock”), at a purchase price of $1,000 per share. The Preferred Stock is convertible into shares of our common stock, par value $1.50 per share (the “Common Stock”), at an initial conversion price of $21.25 per share, subject to customary anti-dilution adjustments. Each share of Preferred Stock has an initial liquidation preference of $1,000, which will be increased at the rate of 5.5% per annum, compounded quarterly, to the extent the Company does not elect to pay such amount in cash for such quarterly period (such amount, “Accreted Return”). The initial liquidation preference of the Preferred Stock, as increased as a result of any such accumulated Accreted Return, is referred to as the “Liquidation Preference.” For a more detailed description of the Preferred Stock, see “Description of the 5.5% Series A Convertible Preferred Stock.”

The Investment Agreement provides that the Private Placement can occur in multiple tranches. The first issuance of Preferred Stock (the “First Closing”) occurred on August 5, 2020 (the “First Closing Date”), when the Crestview Parties purchased an aggregate of 135,000 shares of Preferred Stock (the “First Closing Shares”), for an aggregate purchase price of $135 million. Pursuant to the Investment Agreement, for 12 months following the First Closing, the Company has the option to require the Crestview Parties to purchase, in the aggregate, in one or more additional closings (such closings, the “Subsequent Closings”), up to 45,000 shares of additional Preferred Stock (such shares, the “Subsequent Closing Shares” and, together with the First Closing Shares, the “Purchased Shares”), on the same terms and conditions as the First Closing Shares, for an aggregate purchase price of $45 million, subject to satisfaction of certain closing conditions.

The Company has complied with the conditions of the temporary waiver of certain of the stockholder approval requirements in Section 312.03 ofindependent under the New York Stock Exchange (“NYSE”) Listed Company Manual set forth inlisting standards, applicable SEC rules and regulations, and our Corporate Governance Guidelines (the “Guidelines”).

SKILLS, QUALIFICATIONS, AND EXPERIENCE OF DIRECTORS Our Board believes that our directors should have certain qualifications and has concluded that each of our directors, including the Securitiesnominees, possess the following specific qualifications and Exchange Commission (“SEC”) Release No. 34-88572, as extended by SEC Release No. 34-89219 (the “NYSE Waiver”), as applicableshould serve on the Board:

Commitment to the issuancelong-term interests of our shareholders;

Highest ethical standards and integrity;

Willingness to act on and be accountable for Board decisions;

Ability to provide informed and thoughtful counsel to Management on a range of issues;

History of achievement that reflects superior standards for himself/herself and others;

Loyalty and commitment to driving our Company’s success;

Willingness to ask questions and pursue answers;

Ability to take tough positions, while at the Preferred Stock insame time work as a team player;

Willingness to devote sufficient time to carry out effectively all Board duties and responsibilities, and a commitment to serve on the First ClosingBoard for an extended period;

Adequate time to spend learning our businesses; and

Individual background that provides a portfolio of experience, knowledge, and personal attributes commensurate with our needs.

Our Bylaws provide that, from time to time, the

Common Stock issuable on conversion thereof.As described inBoard shall fix the number of directors, other than those elected by the holders of one or more detail below, in accordance withseries of our preferred stock. Pursuant to the terms of the Investment Agreement and the Certificate of Designations forgoverning the 5.5% Series A Convertible Preferred Stock (the “Certificate of Designations”“Preferred Stock”) and the applicable rules, regulations, guidance and interpretations of the NYSE, the Company is calling this Special Meetingissued to consider and vote upon proposals to approve certain future issuances of Preferred Stock and related technical features of the Preferred Stock. The Special Meeting described in this proxy statement is scheduled to be held on , 2020, and we are providing these proxy materials to you in connection with the Special Meeting.

At the Special Meeting, our stockholders entitled to vote at the Special Meeting will be asked to consider and vote upon the following proposals:

| | | | |

| | VIAD CORP | GENERAL INFORMATION ABOUT THE SPECIAL MEETING | | 1

|

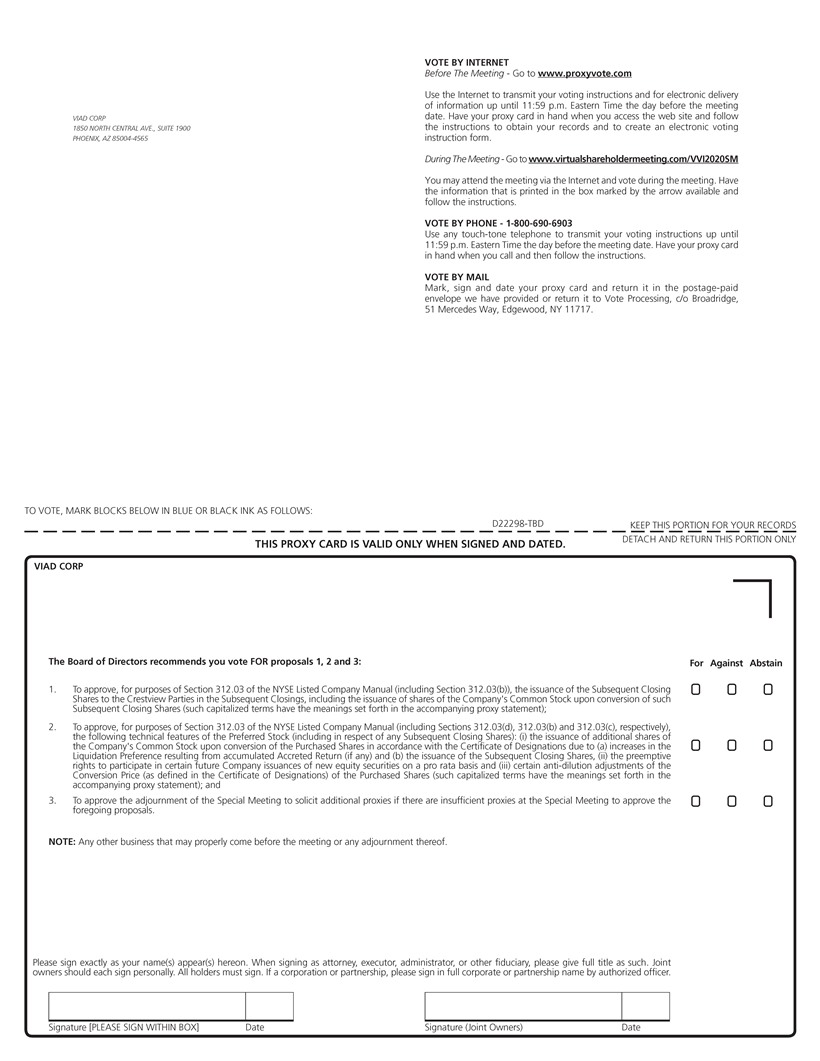

| 1. | To approve, for purposes of Section 312.03 of the NYSE Listed Company Manual (including Section 312.03(b)), the issuance of the Subsequent Closing Shares to the Crestview Parties in the Subsequent Closings, including the issuance of shares of the Company’s Common Stock upon conversion of such Subsequent Closing Shares (the “Subsequent Placement Proposal”).

|

| 2. | To approve, for purposes of Section 312.03 of the NYSE Listed Company Manual (including Sections 312.03(d), 312.03(b) and 312.03(c), respectively), the following technical features of the Preferred Stock (including in respect of any Subsequent Closing Shares): (i) the issuance of additional shares of the Company’s Common Stock upon conversion of the Purchased Shares in accordance with the Certificate of Designations due to (a) increases in the Liquidation Preference resulting from accumulated Accreted Return (if any) and (b) the issuance of the Subsequent Closing Shares, (ii) the preemptive rights to participate in certain future Company issuances of new equity securities on a pro rata basis and (iii) certain anti-dilution adjustments of the Conversion Price (as defined in the Certificate of Designations) of the Purchased Shares (collectively, the “Preferred Stock Rights Proposal”).

|

| 3. | To approve the adjournment of the Special Meeting to solicit additional proxies if there are insufficient proxies at the Special Meeting to approve the foregoing proposals (the “Adjournment Proposal”).

|

This proxy statement, along with the accompanying Notice of Special Meeting of Stockholders, summarizes the information you need to know to vote by proxy or in person (virtually) at the Special Meeting. You are invited to virtually attend the Special Meeting to vote on the proposals described in this proxy statement. However, you do not need to attend the Special Meeting to vote your shares. Instead, you may simply follow the instructions below to submit your proxy in advance of the meeting.

WHY ARE THE SUBSEQUENT PLACEMENTS IMPORTANT TO THE COMPANY?

The Subsequent Placements would allow the Company to access additional fully committed financing which could be used for general corporate expenses and to satisfy the Company’s Liquidity Covenant (as defined below) if needed, due to further changes in economic conditions or to accelerate growth of the Company’s business.

WHAT WILL HAPPEN IF THE COMPANY’S STOCKHOLDERS DO NOT APPROVE THE SUBSEQUENT PLACEMENT PROPOSAL OR THE PREFERRED STOCK RIGHTS PROPOSAL?

If we do not obtain the requisite stockholder approval of the Subsequent Placement Proposal at the Special Meeting, the issuance of Preferred Stock in the Subsequent Closings may not occur if, under applicable NYSE rules, stockholder approval would be required for such Subsequent Closing. Accordingly, we may not receive the additional gross proceeds of approximately $45 million from the Crestview Parties as payment for the Subsequent Closing Shares.

If we do not obtain the requisite stockholder approval of the Preferred Stock Rights Proposal, the Company may not issue additional shares of the Company’s Common Stock upon conversion of the Purchased Shares due to (a) increases in the Liquidation Preference resulting from accumulated Accreted Return (if any) or (b) the issuance of the Subsequent Closing Shares to the extent such issuance would result in the Crestview Parties, in the aggregate, beneficially owning (without counting any Common Stock transferred to a non-affiliated holder of Preferred Stock) shares of Common Stock in excess of 29.9% of the then-outstanding Common Stock (treating shares of Common Stock issuable upon conversion of all of the Preferred Stock as outstanding for this purpose) (such limitation, the “Ownership Limitation”). Additionally, the Crestview Parties may not exercise their preemptive rights to the extent stockholder approval is required as a result of the Crestview Parties’ status as affiliates of the Company or pursuant to other applicable rules and regulations of the NYSE. Finally, if our stockholders do not approve the Preferred Stock Rights Proposal, the conversion price of the Preferred Stock cannot be adjusted below $15.23 in connection with certain dilutive issuances of Common Stock at a price below the then-current market price.

| | | | |

2 | | VIAD CORP | GENERAL INFORMATION ABOUT THE SPECIAL MEETING

| |  |

WHO CAN VOTE AT THE SPECIAL MEETING?

You may vote your Viad stock if our records show that you held your shares as of the Record Date, which was , 2020. At the close of business on the Record Date, a total of shares of Common Stock and shares of Preferred Stock were outstanding and entitled to vote. In accordance with our Restated Certificate of Incorporation, each share of Common Stock is entitled to one vote at this Special Meeting. At the close of business on the First Closing Date, a total of 135,000 shares of Preferred Stock were outstanding, which would be convertible into 6,352,941 shares of Common Stock. Pursuant to the Certificate of Designations, the holders of Preferred Stock will generally be entitled to vote with the holders of shares of Common Stock on all matters submitted for a vote of shares of Common Stock (voting together with the holders of shares of Common Stock as one class) on an as-converted basis, subject to the Ownership Limitation.

On August 10, 2020, the Company and the Crestview Parties filed the required forms and requested early termination of the waiting period under the Hart-Scott-Rodino Antitrust Improvements Act of 1976, as amended, with the Antitrust Division of the Department of Justice and the U.S. Federal Trade Commission. In Canada, the parties filed a request for an advance ruling certificate under the Canadian Competition Act, along with their notifications under Part IX of the Canadian Competition Act on August 10 (Viad) and August 11 (Crestview).

Pursuant to the Stockholders Agreement among the Company and each Crestview Party (as described further below), each Crestview Party has agreed to vote all of the Purchased Shares, Common Stock issued upon conversion of the Purchased Shares, and any other shares of Common Stock held by them in favor of the Subsequent Placement Proposal and the Preferred Stock Rights Proposal, representing approximately 23.8% of the voting power of the shares outstanding as of the First Closing Date.

WHAT ARE THE BOARD’S VOTING RECOMMENDATIONS?

The following table summarizes the proposals to be voted on at the Special Meeting and our Board’s voting recommendations with respect to each proposal.

| | | | | | |

Proposals | | Board’s | | Recommendation |

1.

| | Approval of the Subsequent Placement Proposal

| | ✓ | | FOR |

2.

| | Approval of the Preferred Stock Rights Proposal

| | ✓ | | FOR |

3.

| | Approval of the Adjournment Proposal

| | ✓ | | FOR |

WHAT IS A “BROKER NON-VOTE”?

Generally, “broker non-votes” occur when shares held by a broker in “street name” for a beneficial owner are not voted with respect to a particular proposal because the broker (1) has not received voting instructions from the beneficial owner and (2) lacks discretionary voting power to vote those shares. A broker is entitled to vote shares held for a beneficial owner on “routine” matters. However, absent instructions from the beneficial owner of such shares, a broker is not entitled to vote shares held for a beneficial owner on “non-routine” matters, such as the Subsequent Placement Proposal, the Preferred Stock Rights Proposal and the Adjournment Proposal. If you hold your shares in “street name” or through a broker, it is important that you give your broker your voting instructions. If you hold your shares through a bank, broker or other nominee and you do not provide voting instructions to your nominee, your shares will not be represented at the Special Meeting.

WHAT IS A QUORUM?

For business to be conducted at the Special Meeting, a “quorum” must be present. A majority of the voting power of the outstanding shares entitled to vote generally in an election of directors, represented in person or by proxy, shall constitute a quorum. Abstentions are counted for purposes of determining whether a quorum is present. Because there are no “routine” matters to be voted on at the Special Meeting, “broker non-votes” will not count for purposes of determining whether a quorum is present.

| | | | |

| | VIAD CORP | GENERAL INFORMATION ABOUT THE SPECIAL MEETING | | 3

|

WHAT VOTE IS REQUIRED TO APPROVE EACH OF THE PROPOSALS, AND HOW WILL ABSTENTIONS AND “BROKER NON-VOTES” AFFECT THE OUTCOME?

The following chart describes the proposals to be considered at the Special Meeting, the vote required to adopt each proposal, and the manner in which votes will be counted.

| | | | | | | | |

Proposal | | Voting Options | | Vote Required to Adopt

the Proposal

| | Effect of

Abstentions | | Effect of “Broker

Non-Votes” |

Approval of

Subsequent

Placement

Proposal

| | FOR, AGAINST or ABSTAIN. | | Majority of the votes cast; shares voted FOR the proposal must exceed the number of shares voted AGAINST the proposal. | | An abstention counts as a vote cast AGAINST the

proposal.

| | No effect; no broker discretion to vote. |

Approval of

Preferred Stock

Rights

Proposal

| | FOR, AGAINST or ABSTAIN. | | Majority of the votes cast; shares voted FOR the proposal must exceed the number of shares voted AGAINST the proposal. | | An abstention counts as a vote cast AGAINST the

proposal.

| | No effect; no broker discretion to vote. |

Approval of

Adjournment

Proposal

| | FOR, AGAINST or ABSTAIN. | | Majority of the votes cast; shares voted FOR the proposal must exceed the number of shares voted AGAINST the proposal. | | No effect. An abstention does not count as a vote cast. | | No effect; no broker discretion to vote. |

Approval of the Subsequent Placement Proposal, the Preferred Stock Rights Proposal and the Adjournment Proposal requires the affirmative vote of a majority of the votes cast (in person or by proxy) at the Special Meeting, assuming a quorum is present. Under applicable NYSE interpretation, abstentions are treated as votes cast with respect to the Subsequent Placement Proposal and the Preferred Stock Rights Proposal and, therefore, if you return your proxy card and “ABSTAIN” from voting on such proposals, it will have the same effect as a vote against the Subsequent Placement Proposal and the Preferred Stock Rights Proposal. Abstentions are not considered to be votes cast on the Adjournment Proposal and will not have an effect on the outcome of this proposal. “Broker non-votes” will have no effect on the outcome of the Subsequent Placement Proposal, the Preferred Stock Rights Proposal or the Adjournment Proposal.

ARE THERE VOTING AGREEMENTS RELEVANT TO THE SPECIAL MEETING?

Yes. Pursuant to the Stockholders Agreement among the Company and each Crestview Party, each Crestview Party has agreed to vote all of the Purchased Shares, Common Stock issued upon conversion of the Purchased Shares, and certain other shares of Common Stock, if any, held by them in favor of the Subsequent Placement Proposal and the Preferred Stock Rights Proposal, representing approximately 23.8% of the voting power of the shares outstanding as of the First Closing Date.

HOW DO I ATTEND THE SPECIAL MEETING?

Due to the public health impact of the COVID-19 pandemic and to support the health and well-being of our employees, directors and stockholders, we are hosting the Special Meeting via the internet through a virtual web conference. You will not be able to attend the meeting in person. You will be able to attend the virtual special meeting and vote your shares electronically during the live webcast of the meeting by visiting www.virtualshareholdermeeting.com/VVI2020SM and entering your control number included on your proxy card, or on any additional voting instructions accompanying these proxy materials. The Special Meeting will begin promptly at MST. Online check-in will be available beginning at MST. Please allow ample time for the online check-in process. Please be assured that you will be afforded the same rights and opportunities to participate in the virtual meeting as you would at an in-person meeting.

| | | | |

4 | | VIAD CORP | GENERAL INFORMATION ABOUT THE SPECIAL MEETING

| |  |

If you are a beneficial owner who owns shares through a bank, brokerage firm, or other nominee, you may not vote your shares electronically at the virtual special meeting unless you obtain a “legal proxy” from your bank, brokerage firm, or other nominee who is the stockholder of record with respect to your shares. You may still attend the Special Meeting even if you do not have a legal proxy. For admission to the Special Meeting, visit www.virtualshareholdermeeting.com/VVI2020SM and enter your control number included on your proxy card, or on any additional voting instructions accompanying these proxy materials.

We will have technicians ready to assist you with any technical difficulties you may have accessing the virtual meeting website. If you encounter any difficulties accessing the virtual meeting website during the check-in or meeting time, please call the technical support number that will be posted on the Special Meeting login page.

HOW WILL MY PROXY BE VOTED?

Under NYSE rules, if you are a beneficial stockholder, you may instruct your bank, broker, or other nominee (collectively, a “nominee”) as the holder of record, how to vote your shares. If you do not provide instructions to your nominee, your nominee may still vote your shares, but only on “routine” matters. There are no “routine” matters to be voted on at the Special Meeting. Accordingly, if you do not provide instructions to your nominee, your nominee will not vote your shares on the Subsequent Placement Proposal, the Preferred Stock Rights Proposal or the Adjournment Proposal.

If you are a record holder and return a signed proxy card, the proxy will vote your shares in accordance with your instructions. If you return your signed proxy card, but do not indicate how to vote on the proposals, the proxy will vote your shares “For” each of the proposals. If you are a 401(k) participant, your signed proxy card will instruct the respective plan trustee how to vote your shares. If you do not provide voting instructions, the trustees will vote your shares in accordance with the majority of shares voted in the plans.

WHAT SHOULD I DO IF I RECEIVE MORE THAN ONE PROXY CARD OR OTHER SET OF PROXY MATERIALS?

If you hold your shares in multiple accounts or registrations, or in both registered and street name, you will receive a proxy card for each account. Please sign, date and return all proxy cards you receive. If you choose to vote by phone or by internet, please vote once for each proxy card you receive. Only your latest dated proxy for each account will be voted.

WILL ANY OTHER BUSINESS BE CONDUCTED AT THE SPECIAL MEETING?

The Board knows of no other matters to be considered at the Special Meeting. If any other business should properly come before the Special Meeting, the persons appointed in the enclosed proxy card have discretionary authority to vote in accordance with their best judgment, subject to applicable law.

CAN I CHANGE MY VOTE AFTER I HAVE VOTED?

You may revoke your proxy prior to its exercise at the Special Meeting by:

| ● | | Delivering a signed, written revocation letter, dated later than the proxy, to Derek P. Linde, General Counsel and Corporate Secretary, at our principal executive office as listed in the notice of meeting attached to this Proxy Statement;

|

| ● | | Duly submitting a subsequently dated proxy relating to the same shares of Viad by telephone or via the Internet (using the original instructions provided to you) before on , 2020;

|

| ● | | Duly executing and returning a proxy, dated later than the first one, using the postage-paid envelope provided; or

|

| ● | | Participating in the Special Meeting webcast and voting during the meeting. Your participation at the meeting will not by itself revoke your proxy unless you choose to vote during the meeting.

|

| | | | |

| | VIAD CORP | GENERAL INFORMATION ABOUT THE SPECIAL MEETING | | 5

|

WHO IS PAYING THE COSTS OF THIS PROXY SOLICITATION?

We are providing these proxy materials in connection with the Board’s solicitation of proxies to be voted at our Special Meeting. We will pay for the cost of solicitation. We will solicit proxies primarily through the mail, but our directors, officers, and employees may solicit proxies personally, by telephone, or otherwise, and no additional compensation will be paid to them. We will also reimburse nominees and other fiduciaries for their reasonable expenses in sending proxy materials to beneficial owners of Viad shares.

In addition, we have retained Innisfree M&A Incorporated to assist in the solicitation of proxies and otherwise in connection with the Special Meeting for an estimated fee of $25,000, plus reimbursement of certain reasonable fees and expenses. We have also agreed to customarily indemnify Innisfree M&A Incorporated against certain claims.

HOW DO I VOTE?

Your vote is important! Please cast your vote and play a part in Viad’s future.

Stockholders of record, who hold shares registered in their names, can vote by:

| | | | |

| |  | |  |

Internet

Vote at the website listed on the enclosed proxy card

| | Toll-free from the U.S. or Canada

Vote using the telephone number listed on the enclosed proxy card

| | Mail

Return the signed proxy card in the postage-paid envelope provided

|

The deadline for voting online or by telephone is 11:59 p.m. ET on , 2020. If you vote by mail, your proxy card must be received before the Special Meeting. If you hold shares in a Viad 401(k) plan, your voting instructions must be received by 11:59 p.m. ET on , 2020.

Stockholders of record may vote online during the Special Meeting. Beneficial owners, who own shares through a bank, brokerage firm, or other nominee, may vote online during the Special Meeting as described below. You may cast your vote electronically during the Special Meeting using the control number included on your proxy card, or on any additional voting instructions accompanying these proxy materials. If you do not have a control number, please contact your broker, bank, or other nominee as soon as possible so that you can be provided with a control number.

Beneficial owners, who own shares through a bank, brokerage firm, or other nominee, can vote by completing and returning the enclosed voting instruction form in the postage-paid envelope provided, or by following the instructions for voting via telephone or the internet, as provided by the bank, broker, or other nominee. If you own shares in different accounts or in more than one name, you may receive different voting instructions for each type of ownership. Please vote all of your shares.

If you are a stockholder of record or a beneficial owner who has a legal proxy to vote the shares, you may choose to vote during the Special Meeting. Even if you plan to participate in our Special Meeting via virtual web conference, please cast your vote as soon as possible.

During the Special Meeting, a list of stockholders entitled to vote will be available for examination at www.virtualshareholdermeeting.com/VVI2020SM. The list will also be available for 10 days prior to the Special Meeting at our principal executive office at the address listed above.

HOW CAN I FIND OUT THE RESULTS OF THE VOTING AT THE SPECIAL MEETING?

Preliminary voting results will be announced at the Special Meeting and we will report the final results in a Current Report on Form 8-K, which we intend to file with the SEC after the Special Meeting.

| | | | |

6 | | VIAD CORP | GENERAL INFORMATION ABOUT THE SPECIAL MEETING

| |  |

WHAT HAPPENS IF THE SPECIAL MEETING IS POSTPONED OR ADJOURNED?

If the Special Meeting is postponed or adjourned due to a lack of a quorum or to solicit additional proxies, we intend to reconvene the Special Meeting as soon as reasonably practical. Your proxy will still be effective and may be voted at the rescheduled or adjourned meeting, and you will still be able to change or revoke your proxy until it is voted at the rescheduled or adjourned meeting.

WHO SHOULD I CALL WITH OTHER QUESTIONS?

If you have additional questions about these proxy materials or how to vote at the Special Meeting, please contact Innisfree M&A Incorporated. Stockholders may call toll-free at 877-456-3442. Banks and brokers may call collect at 212-750-5833.

| | | | |

| | VIAD CORP | GENERAL INFORMATION ABOUT THE SPECIAL MEETING | | 7

|

PROPOSAL 1: SUBSEQUENT PLACEMENT PROPOSAL

OVERVIEW

As previously disclosed, on August 5, 2020, the Company entered into the Investment Agreement with the Crestview Parties, pursuant to which the Company agreed to issue and sell to the Crestview Parties up to an aggregate of 180,000 newly issued shares of Preferred Stock, at a purchase price of $1,000 per share (the “Private Placement”).

The Investment Agreement provides that the Private Placement can occur in multiple tranches. The First Closing occurred on August 5, 2020, when the Crestview Parties purchased an aggregate of 135,000 shares of Preferred Stock for an aggregate purchase price of $135 million (the “First Placement”). Pursuant to the Investment Agreement, for 12 months following the First Closing, the Company has the option to require the Crestview Parties to purchase, in the aggregate, in one or more additional Subsequent Closings, up to 45,000 Subsequent Closing Shares, on the same terms and conditions as the First Closing Shares, for an aggregate purchase price of $45 million, subject to satisfaction of certain closing conditions (the “Subsequent Placements”).

We are asking our stockholders to consider and vote on a proposal to approve, for purposes of Section 312.03 of the NYSE Listed Company Manual (including Section 312.03(b)), the issuance of the Subsequent Closing Shares to the Crestview Parties in the Subsequent Closings, including the issuance of shares of the Company’s Common Stock upon conversion of such Subsequent Closing Shares (the “Subsequent Placement Proposal”).

The terms of the Investment Agreement and the Private Placement were previously reported in the Current Report on Form 8-K filed with the SEC by the Company on August 5, 2020. The Private Placement was approved by the Board on August 4, 2020.

BACKGROUND OF THE PRIVATE PLACEMENT

The Board and the Company’s management regularly review and assess the Company’s operations and performance, financial condition and business strategy, and the various trends and conditions affecting the industry in which the Company operates in relation to the Company’s near-term and long-term financial and strategic goals and plans.

In March 2020, the World Health Organization categorized the Coronavirus Disease 2019 (“COVID-19”) as a pandemic, and the President of the United States declared the COVID-19 outbreak a national emergency. As a result of recommendations and mandates handed down by various local, state and federal government agencies in the United States and across the globe regarding social distancing and containment areas; restrictions on large gatherings and travel; and closures of various event venues, in March 2020 we announced that we had taken proactive measures to mitigate the negative financial and operational impacts of COVID-19 on the conference, exhibition and travel industries. Since then, we substantially reduced our payroll costs through furloughs and other salary reductions, curtailed non-essential capital expenditures, and eliminated discretionary spending. The Company has focused its attention on implementing cost reductions, complying with governmental orders relating to the closure of its operations and/or cancellation of its live events, and securing its liquidity position.

At a special meeting held on March 16, 2020, the Board and management determined that it would be prudent to explore the feasibility of certain potential alternative transactions to protect the Company’s liquidity position, strengthen the Company’s balance sheet, enhance financial flexibility of the Company and to support further growth of the business. Thereafter, the Company engaged Moelis & Company LLC (“Moelis”) as its financial advisor to facilitate this review and Latham & Watkins LLP (“Latham”) as its legal advisor.

On March 17, 2020, the Company borrowed the remaining capacity under its $450 million Second Amended and Restated Credit Agreement (the “Credit Agreement”).

During the following months, the Company and its advisors reviewed various potential alternatives to strengthen the Company’s liquidity position, including cost reductions, asset sales, potential business combination transactions, capital-raising options (including the possibility of issuing equity in a

| | | | |

8 | | VIAD CORP | PROPOSAL 1: SUBSEQUENT PLACEMENT PROPOSAL

| |  |

private placement), and restructuring options. The Company and its advisors also engaged in discussions and negotiations with the lenders under the Credit Agreement regarding certain amendments to the Company’s financial covenants in light of the effect of the COVID-19 outbreak on the Company’s business, financial condition and performance. The Board determined that the Company’s options to obtain incremental debt financing (or consummate other debt-like transactions) were significantly limited due to several factors, including the amount of its outstanding indebtedness; the significant reduction in revenue as a result of the cancellation of live events and other tourism attractions; and the uncertainty regarding the depth and duration of the direct and indirect impacts of the COVID-19 outbreak.

On May 8, 2020, the Company entered into an amendment to the Credit Agreement (the “First Credit Agreement Amendment”) which, among other things, (i) suspended the testing of the interest coverage ratio and the leverage ratio for the fiscal quarter ending June 30, 2020 (the “Testing Suspension”) and (ii) added a new minimum liquidity covenant applicable at all times during the period from the effective date of the amendment until the first business day after we delivered quarterly financial statements and the related compliance certificate for the fiscal quarter ending September 30, 2020 (the “Liquidity Covenant”). Given the short duration of the Testing Suspension, the Board ultimately determined that pursuing a private placement transaction of equity or equity-linked securities would be the most effective, efficient and timely means to achieve the Company’s goals and would be in the best interests of the Company and that another amendment to the Credit Agreement to lengthen the Testing Suspension likely would be required.

At the direction of the Board, beginning in June 2020, representatives of the Company contacted twenty-three potential investors with respect to a potential investment in the Company. Of these twenty-three investors, sixteen, including the Crestview Parties, executed confidentiality agreements with the Company (all of which contained customary standstills) and the remaining potential investors declined to participate after reviewing publicly available information. Of the sixteen investors who executed confidentiality agreements, six, including the Crestview Parties, submitted non-binding proposals for an investment in the Company, including by way of a private placement of (i) convertible preferred equity and/or (ii) non-convertible preferred equity together with the issuance of warrants for Common Stock of the Company. The Board believed that the initial proposal from the Crestview Parties provided the most favorable economic terms and structure, and also provided the most financial flexibility for the Company, but the Board determined to continue discussions with five potential investors, including the Crestview Parties.

At a special meeting of the Board on July 6, 2020, the Board reviewed the Crestview Parties’ non-binding proposal to participate in a private placement of preferred equity of the Company which included (i) an initial investment amount of $100-130 million, (ii) the ability for the Company to cause an additional fully-committed investment of $30-42 million increasing pro rata with the initial draw and within twelve months of the initial investment (the “Additional Liquidity Commitment”), (iii) a conversion price of $24.50 per preferred share, and (iv) a cumulative dividend of 4.9% per annum. As of July 6, 2020, the conversion issue price per share represented a 36.2% premium to the 10-day trailing volume-weighted average Common Stock price of the Company. The Board discussed the Crestview Parties’ non-binding proposal, including the Additional Liquidity Commitment and the importance of the Company’s potential to access additional fully-committed financing which could be used for general corporate expenses and to satisfy the Liquidity Covenant if needed, due to further changes in economic conditions and/or to accelerate growth of the Company’s businesses. In light of the foregoing, the Board (a) authorized representatives of the Company to request that the Crestview Parties increase the size of the initial investment amount and the Additional Liquidity Commitment and (b) determined that the proposal of the Crestview Parties provided the most favorable economic terms and structure, and also provided the most financial flexibility for the Company and, upon an agreement with respect to an increase in the size of the initial investment amount and the Additional Liquidity Commitment, it was in the best interest of the Company to enter into exclusivity with the Crestview Parties.

On July 8, 2020, in response to the Company’s request, the Crestview Parties delivered a revised non-binding proposal to participate in a private placement of preferred equity of the Company which included (i) an initial investment amount of $135 million and (ii) an increased Additional Liquidity Commitment of $45 million. On July 8, 2020, the Crestview Parties and the Company entered into a customary exclusivity agreement, which provided that the Company would negotiate exclusively with the Crestview Parties until July 15, 2020. The exclusivity period was subsequently extended by the mutual agreement of the Company and the Crestview Parties until July 29, 2020.

| | | | |

| | VIAD CORP | PROPOSAL 1: SUBSEQUENT PLACEMENT PROPOSAL | | 9

|

During July 2020, the Crestview Parties and their advisors, including their legal counsel Paul, Weiss, Rifkind, Wharton & Garrison LLP (“Paul Weiss”), conducted substantial due diligence on the Company and its operations, including in-person meetings and access to an electronic data room containing certain business, financial, legal and other information. In addition, Paul Weiss and Latham exchanged drafts of the definitive documents necessary to consummate the transaction.

Also during July 2020, in light of the continuing effects of the COVID-19 outbreak on the Company’s business, the Company entered into negotiations in respect of an amendment to the Credit Agreement contingent upon the consummation of the First Closing, which would provide for, among other things, a further suspension of the testing of the interest coverage ratio and the leverage ratio.

On July 28, 2020, in light of (a) ongoing due diligence of the Company by Crestview, (b) the expected continued impact of the COVID-19 outbreak on the Company’s business, and (c) the recent decline in the Company’s stock price, the Crestview Parties approached the Company with a revised non-binding proposal for the transaction that included (i) a cumulative dividend of 5.9% and (ii) a conversion price of $20.50 per share. After discussion between representatives of the Company and the Crestview Parties, on July 29, 2020, the Crestview Parties submitted a revised non-binding proposal for the transaction that included (a) a cumulative dividend of 5.5% and (b) a conversion price of $21.25 per share.

At a special meeting of the Board on July 30, 2020, the Board reviewed, with the assistance of Moelis, the revised non-binding transaction terms proposed by the Crestview Parties. The Board discussed the benefits of the Crestview Parties’ proposal, including that (i) it provided a large single source of capital for the Company, (ii) the Additional Liquidity Commitment provided potential access to fully-committed financing which could be used for general corporate expenses and to satisfy the Liquidity Covenant if needed, due to further changes in economic conditions or to accelerate growth of the Company’s businesses, (iii) it provided capital that was less restrictive than debt, (iv) as of July 30, 2020, the conversion price was at a 36.1% premium to the 10-day trailing volume-weighted average Common Stock price of the Company, and (v) the Board believed that the strategic relationship with the Crestview Parties provides significant benefits to the Company as a result of Crestview’s broad business relationships, including the Crestview Parties’ experience in both the live events and the travel/hospitality industries. Additionally, the Board believed that the Crestview Parties, through their representation on the Board, would provide valuable insight to the Company as it continues to execute its strategy. Notably, one of the Crestview Parties’ Board representatives, Kevin Rabbitt, has direct experience leading the Company’s GES business as its President from 2006 through 2009.

After discussion, the Board determined that the proposal of the Crestview Parties provided the most favorable economic terms and structure, and provided the most financial flexibility for the Company and it was in the best interest of the Company to continue negotiations with the Crestview Parties and finalize definitive documentation. On that same day, the exclusivity period was extended by the mutual agreement of the Company and the Crestview Parties until August 5, 2020.

On August 5, 2020, the Company entered into the Investment Agreement with the Crestview Parties, pursuant to which the Company agreed to issue and sell to the Crestview Parties up to an aggregate of 180,000 newly issued shares of Preferred Stock, at a purchase price of $1,000 per share in the Private Placement. The Investment Agreement provides that the Private Placement can occur in multiple tranches. Pursuant to the Investment Agreement, on August 5, 2020, the Company issued and sold an aggregate of 135,000 shares of Preferred Stock for an aggregate purchase price of $135 million. Pursuant to the Investment Agreement, for 12 months following the First Closing, the Company has the option to require the Crestview Parties to purchase, in the aggregate, in one or more additional closings, up to $45 million in additional Preferred Stock, on the same terms and conditions as the First Closing Shares. As of August 4, 2020 and August 5, 2020, the conversion price was at a 41.3% and 42.2% premium to the 10-day trailing volume-weighted average Common Stock price of the Company, respectively.

Also on August 5, 2020, the Company entered into an amendment of the Credit Agreement which, among other things, (i) suspended the testing of the interest coverage ratio and the leverage ratio for any fiscal quarter ending on or before June 30, 2022 and (ii) continued the Liquidity Covenant until the first business day after the Company

| | | | |

10 | | VIAD CORP | PROPOSAL 1: SUBSEQUENT PLACEMENT PROPOSAL

| |  |

delivers quarterly financial statements and the related compliance certificate for the fiscal quarter ending September 30, 2022.

REASONS FOR THE PRIVATE PLACEMENT

As described in more detail in the section entitled “Background of the Private Placement,” we undertook a process to seek a private placement transaction in order to improve our liquidity position in an effective, efficient and timely manner. The Board determined that the private placement with the Crestview Parties was in the best interest of the Company because (i) it provided a large single source of capital for the Company, (ii) the Additional Liquidity Commitment provided potential access to fully-committed financing which could be used for general corporate expenses and to satisfy the Liquidity Covenant if needed, due to further changes in economic conditions or to accelerate growth of the Company’s businesses, (iii) it provided capital that was less restrictive than debt, (iv) the conversion price negotiated was at a 28.1% premium to the 30-day trailing volume-weighted average common stock price of the Company, and (v) the Board believed that the strategic relationship with the Crestview Parties will provide significant benefits to the Company as a result of Crestview’s broad business relationships, including the Crestview Parties’ experience in both the live events and the travel/hospitality industries. Additionally, the Board believed that the Crestview Parties, through their representation on the Board, would provide valuable insight to the Company as it continues to execute its strategy.

The Private Placement resulted in aggregate gross proceeds to the Company of $135 million with the option for the Company to receive additional proceeds of $45 million within the next 12 months.

REASONS FOR SEEKING STOCKHOLDER APPROVAL

The Company’s Common Stock is listed on the NYSE and, as a result, the Company is subject to certain NYSE listing rules and regulations. Pursuant to Section 312.03(c) of the NYSE Listed Company Manual, subject to certain exceptions, stockholder approval is required prior to the issuance of common stock, or of securities convertible into or exercisable for common stock, in any transaction or series of related transactions if: (1) the common stock has, or will have upon issuance, voting power equal to or in excess of 20% of the voting power outstanding before the issuance of such stock or of securities convertible into or exercisable for common stock or (2) the number of shares of common stock to be issued is, or will be upon issuance, equal to or in excess of 20% of the number of shares of common stock outstanding before the issuance of the common stock or of securities convertible into or exercisable for common stock. In connection with the First Placement, the Company issued 135,000 shares of Preferred Stock to the Crestview Parties, which will be convertible into a number of shares of Common Stock representing approximately 31.1% of our outstanding Common Stock prior to such issuance.

On April 6, 2020, the SEC approved an immediately effective rule change requested by the NYSE to waive the application of certain of the stockholder approval requirements set forth in Section 312.03 of the NYSE Listed Company Manual through June 30, 2020. On July 2, 2020, this waiver was extended through and including September 30, 2020, as set forth in SEC Release No. 34-89219. The Company consummated the First Closing and the First Placement in reliance on and in compliance with the conditions allowing for the waiver of stockholder approval under Section 312.03(c) as set forth in SEC Release No. 34-89219.

However, the issuance of the Subsequent Closing Shares may require stockholder approval under applicable NYSE rules. Pursuant to Section 312.03(b) of the NYSE Listed Company Manual, stockholder approval is required prior to the issuance of common stock, or of securities convertible into or exercisable for common stock, in any transaction or series of related transactions, to (1) a director, officer or substantial security holder of the Company (each a “Related Party”), (2) a subsidiary, affiliate or other closely related person of a Related Party or (3) any company or entity in which a Related Party has a substantial direct or indirect interest, in each case, if the number of shares of common stock to be issued, or if the number of shares of common stock into which the securities may be convertible or exercisable, exceeds either 1% of the number of shares of common stock or 1% of the voting power outstanding before the issuance. In connection with the First Closing, each of the Crestview Parties became a Related Party, and as such, Section 312.03(b) could be implicated upon the future issuance of Subsequent Closing Shares in a Subsequent Closing. Accordingly, the Company is seeking the approval of its stockholders for the Subsequent

| | | | |

| | VIAD CORP | PROPOSAL 1: SUBSEQUENT PLACEMENT PROPOSAL | | 11

|

Placement Proposal to satisfy the requirements of Section 312.03 of the NYSE Listed Company Manual (including Section 312.03(b)).

INTERESTS OF CERTAIN PERSONS

On August 5, 2020, Brian Cassidy and Kevin Rabbitt were appointed to our Board pursuant to the Crestview Parties’ director nomination rights under the Stockholders Agreement. Mr. Cassidy sits on the investment committee of Crestview Partners IV GP, L.P., which is the beneficial owner of the First Closing Shares and will be the beneficial owner of the Subsequent Closing Shares issued to the Crestview Parties. Mr. Rabbitt is an Operating Executive at Crestview Advisors, L.L.C. Based on the capitalization of the Company as of the First Closing Date, the issuance of the Subsequent Closing Shares, and the Common Stock issuable on conversion thereof at the initial conversion rate, would result inaffiliated entities (the “Crestview Parties”), the Crestview Parties, owning approximately 29.3% of our outstanding common stock after giving effectvoting as a separate class, are entitled to such issuance and conversion.

Because Mr. Cassidy and Mr. Rabbitt did not join our Board until after the consummation of the First Placement, they did not participate in their capacity aselect two directors in discussions of, or vote with respect to matters related(the “Preferred Directors”) to the sale of the First Closing Shares, and were not members of the Board when the Board voted to recommend approval by our stockholders of the Subsequent Placement Proposal or the Preferred Stock Rights Proposal.

Except as described above, no person who has served as an officer or director of the Company since the beginning of our last fiscal year, and no associate of such a person, has any substantial interest in this proposal, other than (i) as a result of his or her role as an officer or director of the Company or (ii) in his or her role as a stockholder of the Company in proportion to his or her percentage shareholding.

CONSEQUENCES IF STOCKHOLDER APPROVAL IS NOT OBTAINED

If we do not obtain the requisite stockholder approval of the Subsequent Placement Proposal at the Special Meeting, the issuances of Preferred Stock in the Subsequent Closings may not occur, if under applicable NYSE Rules, stockholder approval would be required for such Subsequent Closing. Accordingly, we may not receive the additional gross proceeds of approximately $45 million from the Crestview Parties as payment for the Subsequent Closing Shares.

DILUTION AND IMPACT ON EXISTING STOCKHOLDERS

While our Board believes that the Subsequent Placement Proposal is advisable and in the best interest of the Company and our stockholders, you should consider the following factors, together with the other information included in this proxy statement, in evaluating this proposal.

The issuance of the Subsequent Closing Shares, and the Common Stock issuable on conversion thereof, would have a dilutive effect on current stockholders in that the percentage ownership of the Company held by such current stockholders will decline as a result of the issuance. This means that our existing stockholders, other than the Crestview Parties, will own a smaller interest in the Company as a result of such issuance and therefore have less ability to influence significant corporate decisions requiring stockholder approval. Due to the issuance of the First Closing Shares, the Crestview Parties hold approximately 23.8% of the outstanding voting power of the Company as of the First Closing Date. If our stockholders approve the Subsequent Placement Proposal and the Company exercises its right to cause the Subsequent Closings, the Crestview Parties would hold approximately 29.3% of the outstanding voting power of the Company, based on the capitalization of the Company as of the First Closing Date, assuming the issuance of all of the Subsequent Closing Shares. As a result, the Crestview Parties will have significant voting power as well as significant influence over our business and affairs.

| | | | |

12 | | VIAD CORP | PROPOSAL 1: SUBSEQUENT PLACEMENT PROPOSAL

| |  |

VOTE REQUIRED

Pursuant to the rules of the NYSE, the approval of the Subsequent Placement Proposal requires the affirmative vote of a majority of the votes cast (in person or by proxy) at the Special Meeting. This means that there must be more votes “FOR” the proposal than the aggregate of votes “AGAINST” the proposal at the Special Meeting.

Abstentions will be counted as votes cast “AGAINST” this proposal. “Broker non-votes” will have no effect on the outcome of this vote.

The Crestview Parties, which hold 23.8% of the shares of the Company’s Common Stock as of the First Closing Date (including the Preferred Stock outstanding on the First Closing Date, on an as-converted basis), have agreed to vote in favor of the Subsequent Placement Proposal.

RECOMMENDATION OF THE BOARD

THE BOARD UNANIMOUSLY RECOMMENDS THAT STOCKHOLDERS VOTE “FOR” APPROVAL OF THE SUBSEQUENT PLACEMENT PROPOSAL.

| | | | |

| | VIAD CORP | PROPOSAL 1: SUBSEQUENT PLACEMENT PROPOSAL | | 13

|

PROPOSAL 2: THE PREFERRED STOCK RIGHTS PROPOSAL

OVERVIEW

We are asking our stockholders to consider and vote on a proposal to approve, for purposes of Section 312.03 of the NYSE Listed Company Manual (including Sections 312.03(d), 312.03(b) and 312.03(c), respectively), the following technical features of the Preferred Stock (including in respect of any Subsequent Closing Shares): (i) the issuance of additional shares of the Company’s Common Stock upon conversion of the Purchased Shares in accordance with the Certificate of Designations due to (a) increases in the Liquidation Preference resulting from accumulated Accreted Return (if any) and (b) the issuance of the Subsequent Closing Shares (the “Common Stock Issuances”), (ii) the preemptive rights to participate in certain future Company issuances of new equity securities on a pro rata basis (the “Preemptive Rights”) and (iii) certain anti-dilution adjustments of the Conversion Price (as defined in the Certificate of Designations) of the Purchased Shares (the “Anti-Dilution Adjustments”) (collectively, the “Preferred Stock Rights Proposal”).

REASONS FOR SEEKING STOCKHOLDER APPROVAL

The Common Stock Issuances, the Preemptive Rights, and the Anti-Dilution Adjustments may all require stockholder approval under applicable NYSE rules. Pursuant to Section 312.03(d) of the NYSE Listed Company Manual, stockholder approval is required prior to an issuance that will result in a change of control of the Company. Any issuance of additional shares of Common Stock upon conversion of the Purchased Shares due to (a) increases in the Liquidation Preference resulting from accumulated Accreted Return (if any) and (b) the issuance of the Subsequent Closing Shares, when taken together with the First Closing Shares, could result in a change of control of the Company for purposes of the applicable NYSE rules, which would require stockholder approval pursuant to Section 312.03(d) of the NYSE Listed Company Manual.

Additionally, certain issuances of common stock, or of securities convertible into or exercisable for common stock, to a Related Party may require stockholder approval under Section 312.03(b) of the NYSE Listed Company Manual. If the Crestview Parties exercise the Preemptive Rights, they could receive a number of shares of common stock, or a number of shares of common stock into which the securities may be convertible or exercisable, that exceeds either 1% of the number of shares of common stock or 1% of the voting power outstanding before the issuance, which would require stockholder approval pursuant to Section 312.03(b) of the NYSE Listed Company Manual.

Finally, Section 312.03(c) of the NYSE Listed Company Manual requires stockholder approval for issuances of common stock, or securities convertible into common stock, if the issuance will represent more than 20% of the voting power or 20% of the number of shares of common stock outstanding prior to the issuance. However, stockholder approval is not required if the issuance is a bona fide private financing involving a sale for cash of common stock, or securities convertible into or exercisable for common stock, if the price, or the conversion or exercise price, is at least as great as the minimum price as defined by the NYSE Rules (the “NYSE Minimum Price”). The First Closing Shares were sold for a conversion price that was greater than the NYSE Minimum Price. However, pursuant to NYSE interpretation, the Anti-Dilution Adjustments could result in the treatment of the issuance of the Purchased Shares as having a conversion price lower than the NYSE Minimum Price, which would require stockholder approval pursuant to Section 312.03(c) of the NYSE Listed Company Manual.

In order to eliminate any requirement that any Common Stock Issuances, the exercise of the Preemptive Rights or any Anti-Dilution Adjustments would require stockholder approval, we are seeking such approval now as part of the Preferred Stock Rights Proposal. Stockholder approval of the Preemptive Rights will be effective, under NYSE interpretation, for five years from the date of the special meeting of stockholders at which such approval is granted.

| | | | |

14 | | VIAD CORP | PROPOSAL 2: PREFERRED STOCK RIGHTS PROPOSAL

| |  |

CONSEQUENCES IF STOCKHOLDER APPROVAL IS NOT OBTAINED

If we do not obtain the requisite stockholder approval of the Preferred Stock Rights Proposal, the Company may not issue additional shares of the Company’s Common Stock upon conversion of the Purchased Shares due to (a) increases in the Liquidation Preference resulting from accumulated Accreted Return (if any) or (b) the issuance of the Subsequent Closing Shares to the extent such issuance would result in the Crestview Parties, in the aggregate, beneficially owning (without counting any Common Stock transferred to a non-affiliated holder of Preferred Stock) shares of Common Stock in excess of the Ownership Limitation. Additionally, the Crestview Parties may not exercise their Preemptive Rights to the extent stockholder approval is required as a result of the Crestview Parties’ status as affiliates of the Company or pursuant to the applicable rules and regulations of the NYSE. Finally, if our stockholders do not approve the Preferred Stock Rights Proposal, the conversion price of the Preferred Stock cannot be adjusted below $15.23 in connection with certain dilutive issuances of Common Stock at a price below the then-current market price.

VOTE REQUIRED

Pursuant to the rules of the NYSE, the approval of the Preferred Stock Rights Proposal requires the affirmative vote of a majority of the votes cast (in person or by proxy) at the Special Meeting. This means that there must be more votes “FOR” the proposal than the aggregate of votes “AGAINST” the proposal at the Special Meeting.

Abstentions will be counted as votes cast “AGAINST” this proposal. “Broker non-votes” will have no effect on the outcome of this vote.

The Crestview Parties, which hold 23.8% of the shares of the Company’s Common Stock as of the First Closing Date (including the Preferred Stock outstanding on the First Closing Date, on an as-converted basis), have agreed to vote in favor of the Preferred Stock Rights Proposal.

RECOMMENDATION OF THE BOARD

THE BOARD UNANIMOUSLY RECOMMENDS THAT STOCKHOLDERS VOTE “FOR” APPROVAL OF THE PREFERRED STOCK RIGHTS PROPOSAL.

| | | | |

| | VIAD CORP | PROPOSAL 2: PREFERRED STOCK RIGHTS PROPOSAL | | 15

|

PROPOSAL 3: ADJOURNMENT PROPOSAL

OVERVIEW

The Adjournment Proposal, if approved, will allow the Board to adjourn the Special Meeting to a later date or dates to permit further solicitation of proxies. The Adjournment Proposal will only be presented to stockholders in the event that there are insufficient votes for, or otherwise in connection with, the approval of the Subsequent Placement Proposal and the Preferred Stock Rights Proposal.

VOTE REQUIRED

The approval of the Adjournment Proposal requires the affirmative vote of a majority of the votes cast (in person or by proxy) at the Special Meeting. This means that there must be more votes “FOR” the proposal than the aggregate of votes “AGAINST” the proposal at the Special Meeting.

Abstentions and “broker non-votes” are not considered to be votes cast for the foregoing proposal, and, accordingly, will have no effect on the outcome of this vote.

RECOMMENDATION OF THE BOARD

THE BOARD UNANIMOUSLY RECOMMENDS THAT STOCKHOLDERS VOTE “FOR” APPROVAL OF THE ADJOURNMENT PROPOSAL.

| | | | |

16 | | VIAD CORP | PROPOSAL 3: ADJOURNMENT PROPOSAL

| |  |

DESCRIPTION OF THE INVESTMENT DOCUMENTS

The following is a summary of the material1-year terms of the Investment Agreement, the Stockholders Agreement, and the Registration Rights Agreement. While we believe this summary covers the material terms of these agreements, it is qualified in its entirety by reference to the Investment Agreement, the Stockholders Agreement and the Registration Rights Agreement, which are included as Exhibits 10.1, 10.2 and 4.1, respectively, to the Current Report on Form 8-K filed with the SEC by the Company on August 5, 2020. For more information about accessing this Current Report on Form 8-K and other information that we file with the SEC, please see “Incorporation by Reference; Availability of Materials” below.

INVESTMENT AGREEMENT

On August 5, 2020, the Company entered into the Investment Agreement with the Crestview Parties, pursuant to which the Company agreed to issue and sell to the Crestview Parties up to an aggregate of 180,000 newly issued shares of Preferred Stock, at a purchase price of $1,000 per share in the Private Placement. The Investment Agreement provides that the Private Placement can occur in multiple tranches. Pursuant to the Investment Agreement, on August 5, 2020, the Company issued and sold an aggregate of 135,000 shares of Preferred Stock for an aggregate purchase price of $135 million.

Subsequent Closings

Pursuant to the Investment Agreement, for 12 months following the First Closing, the Company has the option to require the Crestview Parties to purchase, in the aggregate, in one or more additional closings, up to $45 million (such additional amount, the “Subsequent Closing Amount”) in additional Preferred Stock on the same terms and conditions as the First Closing Shares. The obligation of the Crestview Parties to purchase additional Preferred Stock at each such Subsequent Closing is subject to certain conditions, including (i) no occurrence of certain material adverse effects with respect to the Company (which excludes the effect of COVID-19 to the extent it does not have an adverse and disproportionate effect on the Company as compared to other companies in its industry) or certain change of control transactions, (ii) the Company continuing to be solvent, according to the criteria set forth in the Investment Agreement, (iii) to the extent required under applicable NYSE rules, receipt of the necessary approval from the Company’s stockholders, (iv) certain fundamental representations and warranties being true and correct as of such Subsequent Closing date and (v) if required by applicable law, approval under Section 41 of the German Act Against Restraints of Competition. Once issued, all Subsequent Closing Shares accrue dividends and have rights as if they were issued at the First Closing.

Restrictions on Transfer

For a period of 18 months following the First Closing, no Crestview Party may transfer any of the Purchased Shares or Common Stock issued upon conversion of the Purchased Shares (the “Conversion Shares”) to any person without the prior written consent of the Company, except each Crestview Party may transfer Purchased Shares and Conversion Shares (i) to (a) any affiliate of such Crestview Party, (b) any successor entity of such Crestview Party or (c) any investment fund, vehicle or similar entity of which such Crestview Party, or any affiliate, advisor or manager of such Crestview Party serves as a general partner, manager or advisor or any successor entity to the person described in this subclause (c), (ii) pursuant to an amalgamation, merger, tender or exchange offer, business combination, acquisition of assets or similar transaction involving the Company or any of its affiliates or any transaction resulting in a change of control of the Company or (iii) following commencement by the Company or any of its significant subsidiaries of bankruptcy, insolvency or similar proceedings. The restrictions on transfer in the Investment Agreement do not prohibit liens on Purchased Shares or Conversion Shares, or any exercise of remedies with respect thereto. Subject to certain exceptions, each Crestview Party also agreed that it would not knowingly transfer Purchased Shares or Conversion Shares to (I) certain competitors of the Company or (II) any person who

| | | | |

| | VIAD CORP | DESCRIPTION OF THE INVESTMENT DOCUMENTS | | 17

|

would, upon consummation of such transfer, beneficially own 5% or more of Common Stock on an-as converted basis.

STOCKHOLDERS AGREEMENT

On August 5, 2020, the Company and each Crestview Party entered into the Stockholders Agreement (the “Stockholders Agreement”).

Additional Growth Capital

Pursuant to the Stockholders Agreement, until the earlier of (i) the three year anniversary of the First Closing and (ii) the date on which any Crestview Party has transferred any equity interests of the Company to a non-affiliated party, the Company has the right to request additional capital from the Crestview Parties in an amount not to exceed $90 million (when aggregated together with the Subsequent Closing Amount) on terms and conditions to be mutually agreed by the Company and each Crestview Party and subject to the approval of the Crestview Parties’ investment committee.

Crestview Parties’ Directors and Nominees

After the expiration or termination of the applicable waiting period under the Hart-Scott-Rodino Antitrust Improvements Act of 1976, as amended, and receipt of the requisite approval under the Canadian Competition Act (the latest of which, the “Antitrust Clearance Date”), and for so long as the Crestview Parties have, in the aggregate, record and beneficial ownership of, on an as-converted basis, at least (i) 67% of the total number of Common Stockshares of common stock issuable upon conversion of the First Closing SharesPreferred Stock issued to them under the Investment Agreementin connection with their initial investment (the “Initial Share Ownership”),. Should they not meet the Crestview Parties will have the right to designate, or nominate for election upon converting the Purchased Shares into Conversion Shares, two members (the “Crestview Designees”) to the Board and (ii) 33% of the Initial Share Ownership, the Crestview Parties will have the right to (a) designate, or nominate for election upon converting the Purchased Shares into Conversion Shares, one member to the Board and (b) appoint one representative to attend the meetings of the Board as a non-voting observer. On August 5, 2020, the Company appointed Brian Cassidy and Kevin Rabbitt to the Board to serve as the Crestview Designees.

Standstill

Subject to certain customary exceptions,67% threshold, the Crestview Parties are prohibited from, among other things, (i) acquiring equity securities of the Company in excess of 2,500,000 shares of Common Stock in the aggregate, (ii) effecting an acquisition, by tender or exchange offer, merger, amalgamation or a similar business combination, of the Companyentitled to elect one director and (iii) soliciting proxies or seeking a director/management change in the Company until the later of (x) three years after the date of the Stockholders Agreement and (y) such timeappoint one non-voting Board observer for so long as the Crestview Parties hold,they have, in the aggregate, record and beneficial ownership of, on an as-converted basis, less thanat least 33% of the Initial Share Ownership (the “Sunset Date”).Ownership. If the Preferred Stock is converted into common stock, but the Crestview Parties maintain ownership above the specified thresholds, the Crestview Parties will have the right to nominate that number of directors for election at an annual meeting of shareholders by all holders entitled to vote in the election of directors.

Currently, we have nine directors on our Board, including the two Preferred Directors. In addition,August 2020, the Board appointed Brian P. Cassidy and Kevin M. Rabbitt to serve as the initial Preferred Directors. The Crestview Parties, as the holders of the Preferred Stock and voting as a separate class, are entitled to elect two Preferred Directors at this year’s Annual Meeting. Pursuant to the Certificate of Designations governing the Preferred Stock, the Crestview Parties are prohibited from engaging in any short sale or any purchase, sale or grantexpected to elect Brian P. Cassidy and Kevin M. Rabbitt, effective as of any securitythe date of this year’s Annual Meeting. The seven remaining directors are divided into three classes. The term of one class of directors expires at each annual shareholders meeting, and nominees are elected to that includes, relatesclass for a term of three years. Two directors, Richard H. Dozer and Virginia L. Henkels, are proposed for election by the shareholders that are entitled to or derives any significant part of its value from a declinevote in the market price or valueelection of directors at this year’s Annual Meeting.

| | | Viad Corp | PROPOSAL 1: ELECTION OF DIRECTORS | | | 1 |